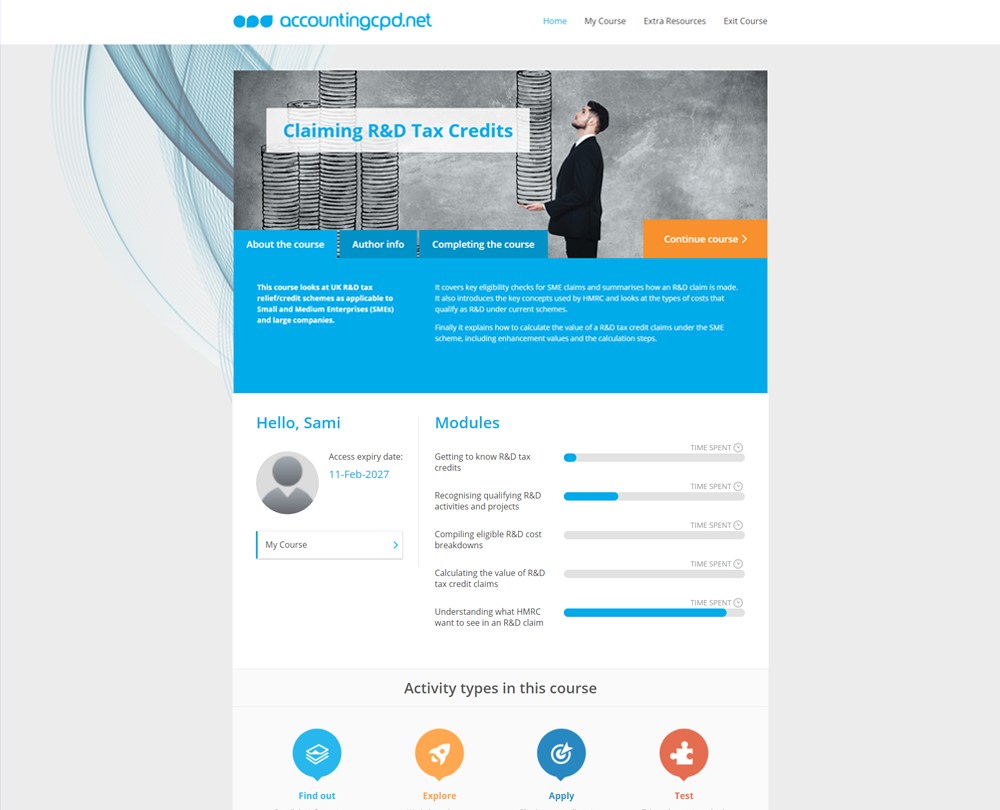

Claiming R&D Tax Credits

This course has been revised and is up to date for 2020-21. Understand qualifying R&D activities, compile appropriate cost breakdowns, calculate the value of the R&D tax credit claim and ensure that you include all the information HMRC wants.

This course is not currently available

This course will enable you to

- Have a good overview of the UK R&D tax relief and credit schemes

- Understand the definitions used by HMRC to assess whether a project qualifies as R&D

- Understand the critical information that is normally included in an R&D claim

- Be able to draw up a checklist of what to include in an R&D claim

About the course

Do you know how to judge whether your company or client is eligible for R&D tax credits? With so much misunderstanding about what qualifies as R&D, the tax credits scheme is still significantly under-utilised, especially in the SME sector.

This course will help you to recognise qualifying R&D activities, compile appropriate cost breakdowns, calculate the value of the R&D tax credit claim and ensure that your claim includes all the information HMRC want to see.

This course has been revised and is up to date for 2020-21

Look inside

Contents

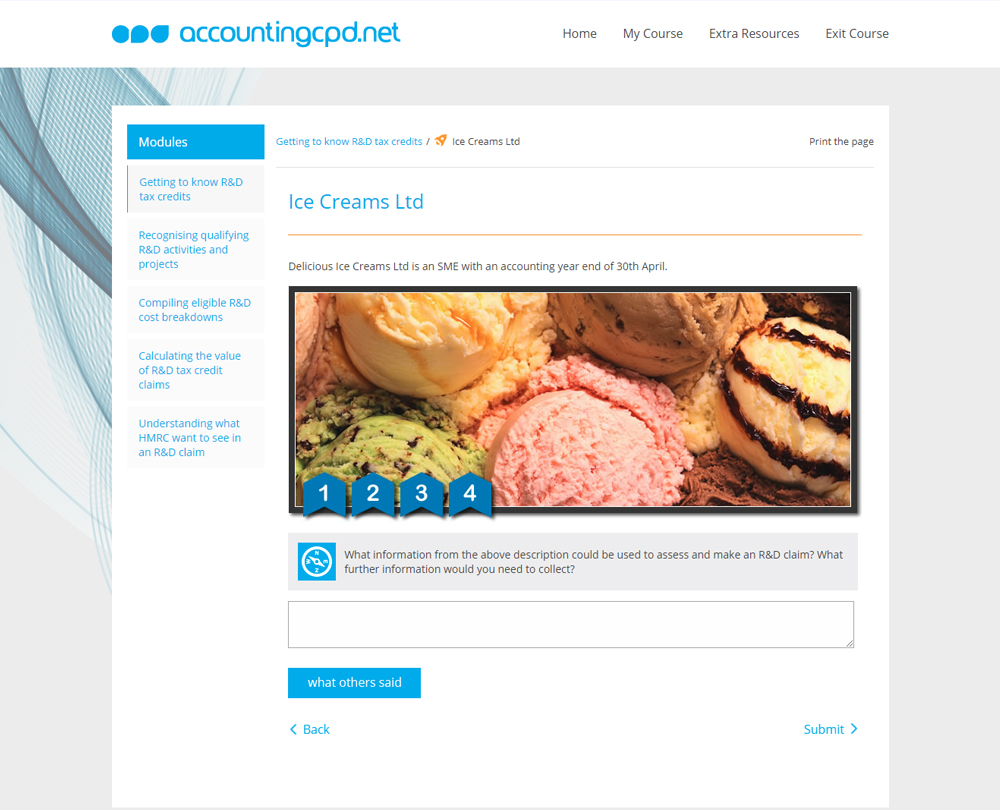

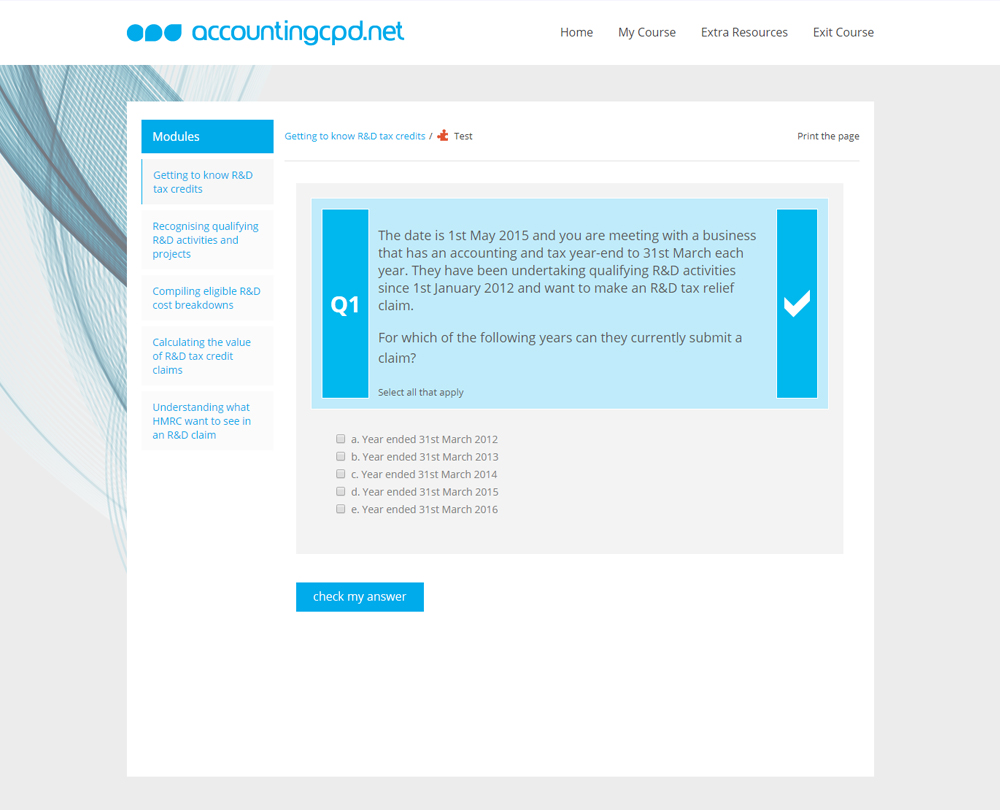

- Getting to know R&D tax credits

- What are R&D tax credits?

- What is the size of the marketplace?

- Who is eligible?

- What are the current claim rates?

- How are R&D tax credit claims submitted?

- Recognising qualifying R&D activities and projects

- How is science and technology defined for R&D claims?

- What advances need to be sought in order to claim?

- What is the concept of scientific and technological uncertainty?

- Who is a competent professional?

- What are the different types of qualifying activity?

- Compiling eligible R&D cost breakdowns

- What qualifying activities and costs can be included in an R&D claim?

- What you need to know when compiling an R&D cost breakdown?

- What are some common pitfalls and how do I avoid them?

- Calculating the value of R&D tax credit claims

- What are R&D enhancement rates?

- What are the calculation steps?

- What if the tax credit rate changes during the company's accounting year?

- What are the R&D elements in a corporation tax return?

- Understanding what HMRC want to see in an R&D claim

- What are the key qualification checks?

- How do we approach the technical justification?

- What does a qualifying costs breakdown include?

- What might trigger a HMRC enquiry? What are their common questions?

How it works

Reviews

You might also like

Take a look at some of our bestselling courses

This course is not currently available. To find out more, please get in touch.